Welcome to another issue of Carbon-Adjusted EBITDAX, the only newsletter for emissions-focused finance professionals in the oil and gas industry.

Do you like Yeti mugs? I do.

If you get 10 of your industry friends to sign up for this newsletter and send me an email verifying it, I will personally send you a nordic blue Iconic Air branded yeti coffee cup and a handwritten thank you note.

Coming soon - Carbon-Adjusted EBITDAX merch. I love quality merch, so I **guarantee** it will be something your friends and coworkers want. Please like, share, and subscribe so I can justify pre-ordering it.

🗣️ One Big Quote - Danielle Patterson, Vinson Elkins

Danielle is a Partner at Vinson Elkins in their Energy Transactions and Projects Practice

Alan: “…what's under-noticed [in the energy transition]?”

The role that oil and gas companies, both upstream and midstream, are playing in the energy transition.

It will take all kinds of backgrounds, experiences and know-how to drive the energy transition forward, and traditional energy companies are well-suited to play a key role in many clean technologies. We see them being some of the front-runners in this space.

Credit: Alan Neuhauser, Axios Climate Tech Newsletter

Not a cheap newsletter, but I’m a very happy subscriber. I met Alan at a happy hour in SF. Axios is good people.

🎧 Chuck Yates & Dan Romito: ESG Strategy & Integration

Favorite quote:

Dan Romito: “Where do you think electricity get its power from?”

Portfolio Manager: “Electricity…”

[Context: even some sophisticated investors don’t know where electricity comes from]

Chuck and Dan get into what ESG is, expected requirements, and strategies for how companies can get ahead of these requirements.

My take on the ESG boogieman: “ESG” is just three letters, but it is getting perverted by extremes.

Incorporating other factors that you see as material risks outside of margins isn’t a crazy idea.

Ex. Diversity makes for more innovative companies, happier employees perform better and stick around so you spend less on recruiting and turnover, investors have a right to know your emissions intensity, etc.

Beating companies over the head with whatever poorly-thought-out project a group has under the guise of “ESG” breeds distrust and justifiably receives pushback.

Ex. trying to sabotage fossil fuel companies through board actions, access to capital, regulations, etc. before there is any realistic alternative

📚 The tabs I’ve had open all week

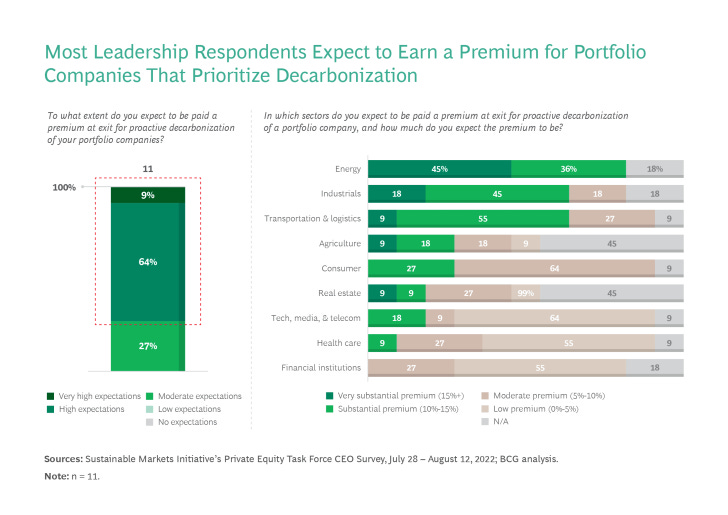

👉 How Investors Can Incorporate Carbon into their Decision Making (BCG)

BCG and the Private Equity Task Force developed voluntary best practices for valuing carbon in the investment process

The framework includes 5 components that impact “carbon-adjusted EBITDA” (I should have trademarked it…)

Regulated Carbon Costs: regulations such as taxes or fines that lead to an actual cash outflow

Internal Carbon Costs: self-imposed price that is intended to represent an expected future cost of carbon

Indirect Carbon Costs: based on the behavior of other market participants, like customers and lenders. Impact can be felt through revenue and costs.

Decarbonization Value Creation: abatement levers, like switching to renewables, used to reduce the above costs of carbon

Carbon-Adjusted Multiple: Investors need to decide when to adjust the market multiple and for how much to account for “future-proofing” a company with carbon performance

A multiple is shorthand for how much a company is worth. Typically its a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). So, for example, industrial companies of a certain type could be trading for 9-12x EBITDA.

Forecasting multiple expansion is very difficult since it’s hard to say what the market will pay for X type of company in 3-7+ years.

Nevertheless, carbon performance value creation will likely show up in the liquidity of the company (i.e., how easy it is to sell because it isn’t harboring any environmental skeletons in its closet) through a higher multiple (or a lower multiple, if you don’t do it), but again, that depends on the market.

The main idea is that PE firms are willing to pay up (way up, as shown in the table below) for future-proofed companies because they want to avoid surprises when taking a company to market in X years

This is interesting, but do the 11 firms surveyed invest in O&G companies? I’m not sure to what extent.

However, some big names with varied exposure to the O&G industry contributed to the study:

Advent International: Some OFS (RGL Reservoir Management, Ocensa, NCS Multistage, BOS Solutions)

Brookfield is all over the energy transition and utilities but doesn’t appear to be invested in private O&G assets

CVC: Partnering with The Carlyle Group on Neptune Energy - an independent E&P in Europe.

EQT: gas compression services (Kodiak Gas Services) and integrated energy company (TBS Energi)

Hellman & Friedman: No current O&G investments, but worth noting that they do currently have a stake in Enverus (formerly DrillingInfo)

Warburg Pincus: Heavy hitter in O&G PE. Investments in Citizen Energy, Terra Energy Partners, Stronghold Energy II, Tall City Exploration, Trident Energy, and Zenith Energy.

Where I expect this will get very contentious is with manufacturing / industrials. Almost every PE firm has some form of an industrials thesis, only a few specialize in oil & gas. Full list of contributors below:

👉 Exxon, Chevron investors vote down all climate-related shareholder proposals (S&P Global)

Activist resolutions called for Scope 3 emissions targets and a variety of reports on emissions data and assessments of stranded asset risks in a net zero world.

The most “popular” resolution (failed at 34.3%) involved Exxon reporting actual methane emissions using an accepted format like the UN OGMP. Exxon currently uses estimates to report its methane emissions.

Why the change of heart since Engine No. 1? Many of the proposals lacked institutional investor support.

Probably because many of the proposals were more intended to disrupt Exxon / Chevron than achieve any meaningful climate objectives.

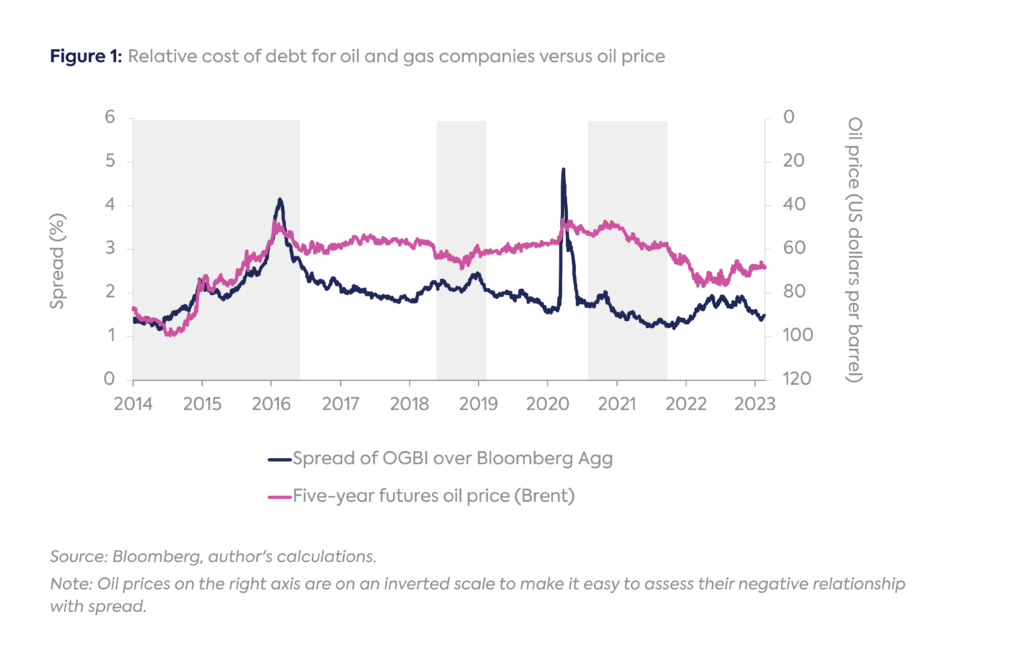

👉 Is ESG Driving Debt Costs Higher for Oil and Gas Companies? (Columbia)

According to this analysis, the answer is “no,” and here is why

Since there isn’t an O&G equivalent to the benchmark Bloomberg Global Aggregate Index (BloombergAgg), the author constructed a composite index based on ratings, liquidity, duration, and diversification

For non-finance majors: rating is the risk of default of the company (70% of O&G companies are investment grade - or BBB+), liquidity is the ability to buy or sell the bond without a drastic change in the price, duration is a bond’s exposure to interest rate movements, and diversification is as it sounds - varied characteristics of bonds to limit exposure to any single variable.

The spread between the aggregate and composite indices was then plotted against the 5-year forward oil prices since institutional investors tend to focus on the long-term outlook for oil

This chart below shows no real correlation between the spread and oil prices. If ESG were having a meaningful impact on the cost of debt for O&G companies, one would expect to see the spread increase over time.

However: more and more banks like BNP Paribas SA (see below) are dropping O&G clients, so we can expect rates to increase as the lending pool decreases.

I’ve heard from O&G execs that, in order to line up a larger lender syndicates, they are starting to produce detailed emissions performance reports to show progress toward net zero. The rationale is that more transparency leads to a larger pool which keeps rates / terms competitive

What is your experience accessing capital? Is this research paper in line what what you have seen?

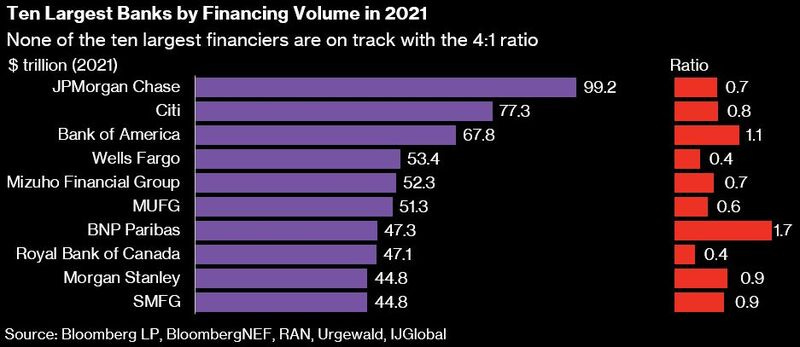

👉 BNP Paribas Exits Bond Arranging for New Oil, Gas Ventures (Bloomberg)

This is an update to last month’s announcement that BNP would phase out its support for non-diversified exploration and production (E&P) firms

Non-diversified companies only operate in the exploration and production, refining, and distribution of oil and gas resources

BNP Paribas SA will no longer help arrange bond deals if the issuer intends to use the proceeds to finance new fossil fuel exploration and production

They will, however, still look at syndicating bonds for O&G companies that are reducing or not expanding their fossil fuel business

I’m going to need an example…

Context: BNP isn’t among the top-10 underwriters of O&G deals, but they are a top 10 financier of corporate debt.

According to the BloombergNEP, the ratio of financing for clean energy relative to fossil fuels must hit 4:1 by the end of the decade to live up to the Paris climate agreement

At the end of 2021, the ratio of was 0.8:1

My take: I’ve seen this number touted before, as well as the needed increase in spending on green energy relative to O&G as of late, but I would like to see more nuance around capital efficiency.

Meaning - if we divert an outsized amount of resources to green energy, will we still be able to power the world? There has to be some balance in the near term.

👉 Duke Energy to sell Commercial Renewables unit in $2.8 bln deal (Reuters)

Duke Energy intends to use the net proceeds of $1.1B from the sale its unregulated utility scale renewables business to incorporate 30,000+ megawatts of regulated renewable energy into its system by 2035

Regulated utility - utilities can hold monopolies and costs are passed on to customers. Leads to lower but more predictable returns.

Unregulated utility - developers and operators compete on cost with more risk but higher upside. Generation can be separate from distribution and transmission.

Duke aims to reduce CO2 emissions by 50%+ by 2030 and achieve net zero by 2050

💵 Financing Update

🔹 Specialist Investor NGP Raises $700 Million for Clean-Energy Fund (WSJ)

$700M for energy transition fund NGP ETP IV LP across 30+ LPs

The Kentucky Teacher’s Retirement System pledged as much as $30M

Four segments: renewable power sources, electrification, energy efficiency, and carbon management

Companies they are investing in have benefited from the Inflation Reduction Act

Targeting underserved growth equity investments in the space

Context: NGP is a staple among O&G PE players, but they are increasingly branching out to capture some of the energy transition returns

🎉 One Fun Thing

Leaked footage of me talking to one of our carbon experts:

Me: Is this Scope 1?

Laura: Yes.

Me: And this?

Laura: No that is Scope 2.

Me: This. Is this Scope 1?

Laura: No, that is Scope 3. Hampton…

Me: And this. This must be Scope 1.

Laura: No…

Context: original video here if you have 4 minutes you will never get back

These are fantastic - hoping you keep up with this! I've shared with a number of colleagues!